Content

Where this can get a little tricky is when you have multiple sources of income. These can be in the form of yearly bonuses, freelance work, or tips. You need to add this amount to your gross income salary to get an answer that’s completely reflective of your income. Net pay is important for creating a budget and planning your financial future. Unlike gross pay, you probably won’t need to know your net pay when applying for loans or big purchases, but it helps you decide whether you can afford these endeavors.

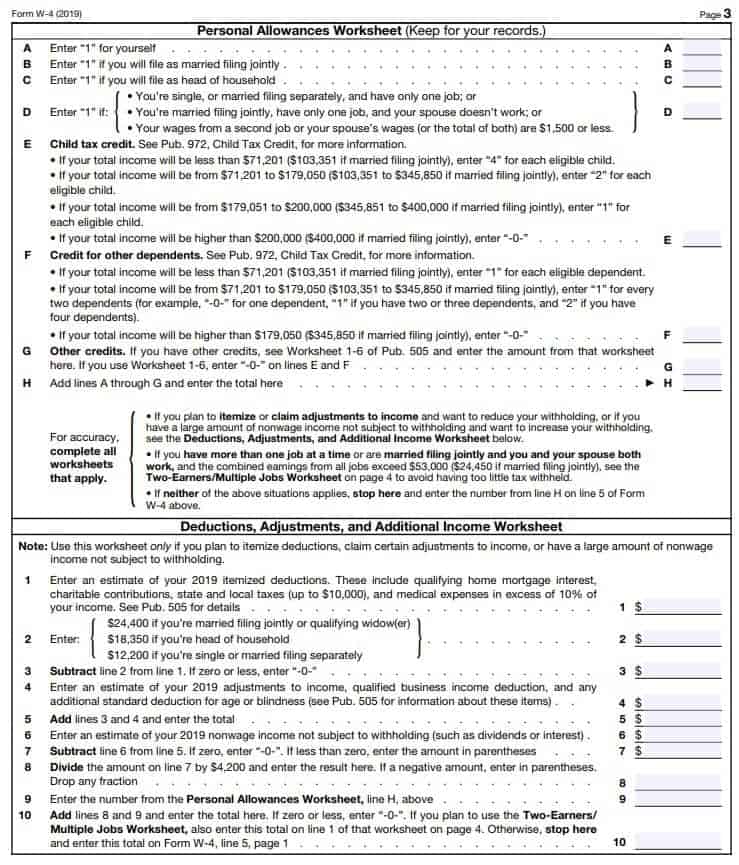

The definition of gross pay can get a bit muddier when it comes to the IRS. Your W-2 will include your gross salary for the year, but employers have to include some non-monetary benefits in their calculations. Lenders turn to an individual’s gross annual income to measure their standard salary before getting into the complexities of deductions and taxes. These two numbers are called gross pay and net pay, and it’s important to understand the difference between the two for your financial planning and reporting.

When it comes to payroll and budget, these terms are crucial to understand. But what’s the difference?

And if you work five https://intuit-payroll.org/ of overtime at $22.50 per hour, you’ll add $112.50 to your regular gross pay for a grand total of $1,312.50. This payment is divided between the employer and the employee – the employee pays their half through their income deductions. The FICA tax is deducted from the employee’s taxable income (after you deduct, for example, the retirement contribution pay, and make other potential pre-tax deductions). Working out the difference, gross pay vs net pay, might seem simple for a company operating in one country, with a workforce all on permanent employment contracts. Some employers may offer car or train ticket loans, or salary advances for other purposes, which are then paid back in instalments from gross pay. Other common deductions might include union dues, charitable donations, childcare costs contributions, or court ordered payments towards debts or child maintenance.

- Net pay, also called take-home pay sometimes, is the amount of money remaining after all withholdings.

- Make sure you take into account any short or long-term bonuses you might receive to land at your total gross number.

- However, calculating gross vs. net salary on a pay period basis does take slightly more work than just reading your employment contract.

- Gross income refers to your total earnings before taxes, employee benefit costs or other deductions are applied.

- The deduction total equals the amount of payroll taxes you must withhold for that specific employee.

- This is what you earn after subtracting “above-the-line” tax deductions from your gross income.

These may include your monthly grocery bill, gas for your car, credit card bill and any other costs that are typically variable. Once you know what you take home every month, start tracking how much you spend every month.

How to calculate gross income for an hourly employee

Instead of working with a set yearly or The Difference Between Gross Pay And Net Pay salary and factoring in a pay period, hourly workers get their salary according to an hourly rate and the number of hours they worked. Gross pay is the amount employees earn before you withhold taxes, benefits and other payroll deductions from their salary. Next, limit your needs category to expenses like groceries, rent or mortgage payments, utilities, health insurance, necessary transportation expenses and medicine. Although the final 20% is for your savings and debt payments, the minimum monthly payment for any debt you have should go into the needs category. If you don’t make the minimum monthly payment on your debt, it could negatively impact your credit score. However, your gross income is not the same as your taxable income.

Check with your HR team to learn more about your health insurance options and costs. Do you need help calculating gross or net pays for your employees or are looking to automate your payroll process all together? Lano’s software solution enables you to simplify your global payroll by automating data flows and consolidating payroll data for the entire team. Shoot us a message and we’ll tell you more about our global payroll solution.

Gross Pay vs. Net Pay: What’s the Difference?

Gross pay will likely always be more than net pay because net pay includes deductions from gross pay. Gross is an employee’s total earnings, such as wages or salary, while net pay is their earnings minus payroll deductions, including taxes, benefits and garnishments. When you’re paid an annual salary, you’ll often see a recurring figure on every payslip, showing your gross pay for that month. Multiply your gross monthly income amount by 12 to find out your annual gross salary. Make sure you take into account any short or long-term bonuses you might receive to land at your total gross number. It also includes other forms of income, including alimony, rental income, pension plans, interest and dividends. For example, Mary is a teacher and her salary is $40,000 per year.